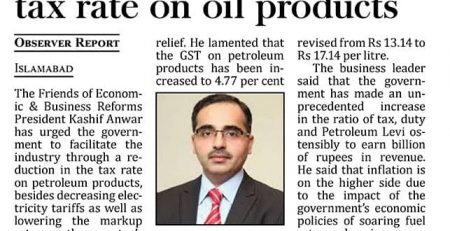

Alternative Energy Resources Need To Explore To Tame Unruly Flight Of Dollar: FEBR

Lahore: In order to tame the unruly flight of dollar new avenue of alternative energy have to be explored as import of oil and petroleum products is a big drain on the forex reserve , piling up the current account deficit.

This was stated by Lahore Chamber of Commerce and Industry (LCCI) former vice president and Friends of Economic and Business Reforms (FEBR) president Kashif Anwar in a statement here Sunday.

Anwar said that the cheaper fuel is utmost important to for industry to enhance exports and curtail current account deficit, thus work on alternative cheaper energy in the form of hyedel and solar projects at both private and public levels is need of the hour.

Liberalisation of policies on solar and hyedel energy will increase the overall share of alternative energy reducing pressure on rupee, he stated, adding that solar energy panels import had been discourage by the imposition of heavy duty and taxes that needs to be revisited besides more and more hyedel power projects should be planned to reduce dependence on the imported petroleum products.

He suggested that the work on hyedel and solar power projects should be undertaken on war footings.

“As a first resort duty and taxes must be removed on solar panels’ import, instead subsidies should be announced. There should be a large scale advertisment campaigns for adaptation of solar energy all across the country. People should be imparted about the beniffits of using solar energy while newly constructed houses must be electrified by solar energy.

In this regard, the government should offer subsidy and the banks should extend soft loans to the public for buying solar panels. The subsidy will pay back the government in the form of lesser burden on the costlier energy made with imported fuel in the future.

Going forward, the government must consider ban on the use of luxury and other such vehicles instead public transport and bicycles should be the top mode of transportation,” Anwar proposed.

He went on saying that economy would further slip down owing to continuous unchecked rise in dollar price against the rupee.

Other strong measures need to be taken to curb the undesirable outflow of dollar including limiting foreign currency carrying and directing exchange companies to ensure biometric verification for all foreign currency sales and trade in local currencies with bordering countries, he believed, explaining an exorbitant devaluation has been being taken place as the inter-bank dollar rate has plunged to Rs 192.95 as on May 13th 2022.

The FEBR president further suggested that trade in local currencies, particularly with China, can also help Pakistan to end the burden of relying on USD in bilateral trade and to bring down the trade deficit.

Pakistan’s mutual trade volume only with China is more than USD 13 billion and if the country makes currency swap agreements with regional countries in general and with China in particular, it will significantly lift pressure off the foreign exchange reserves and dependency on the dollar will be decreased, Anwar explained.

“A stable rupee is crucial to achieve real economic growth. Unfortunately, the Pakistani rupee is continuously falling against the dollar which has had negative impacts on the national economy,” the FEBR president concluded.

Leave a Reply