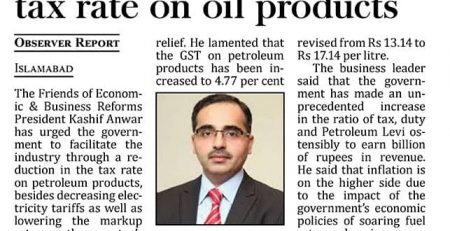

FEBR opposes decision of again empowering tax officials with discretionary powers

FEBR OPPOSES DECISION OF AGAIN EMPOWERING TAX OFFICIALS WITH DISCRETIONARY POWERS.

By Muhammad Jahangir On Oct 14, 2021,

Lahore: Friends of Economic and Business Reforms (FEBR) has strongly opposes the government decision of restoration of powers of the tax officials to freeze the bank accounts for the recovery of taxes.

FEBR president Kashif Anwar said that this step is against the spirit of creating a business friendly environment in the country.

He said that this step would give undue exorbitant powers to the Tax Officials under Section 140 of the Income Tax Ordinance, 2001 and Section 48 of the Sales Tax Act, 1990 which would result in the undue harassment of business community and discourage new entrepreneurs to come into the tax net.

“Previously, the Tax Officials were not allowed to freeze bank accounts without taking permission from the Chairman FBR and intimating the account holder at least 24 hours before minimising discomfort in business community,” he said, adding that

Pakistan is already facing stiff economic challenges like mounting inflation 9%, stagnation in exports and rise in external debt.

In this situation, the businessmen would be encouraged the business community hurting growth rate of the important sectors of economy like Industry and services sector.

The authorities should immediately withdraw the recently issued instructions restoring the confidence of business community, Anwar concluded.

Leave a Reply